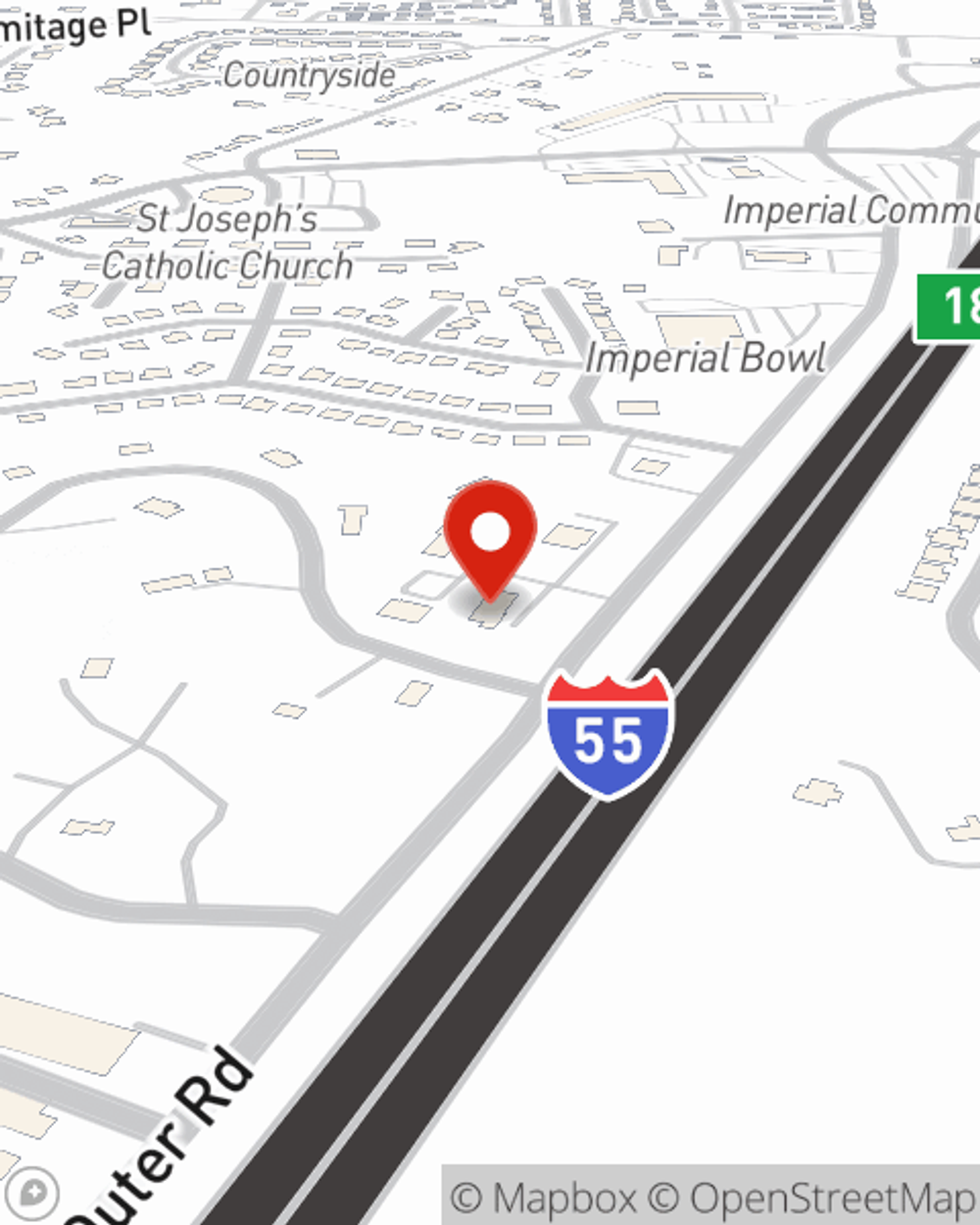

Homeowners Insurance in and around Imperial

Looking for homeowners insurance in Imperial?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

Home is where laundry is continuous memories are created, and you're protected with State Farm's homeowners insurance. It just makes sense.

Looking for homeowners insurance in Imperial?

Apply for homeowners insurance with State Farm

Safeguard Your Greatest Asset

State Farm's homeowners insurance protects your home and your memorabilia. Agent Scott Brase is here to help generate a plan with your specific needs in mind.

Don't let your homeowners insurance go over your head, especially when the unpredictable happens. State Farm can bear the load of helping you get the home coverage you need. And if that's not enough, bundle and save could be the crown molding to your coverage options. Contact Scott Brase today for more information!

Have More Questions About Homeowners Insurance?

Call Scott at (636) 223-2000 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Extension cord safety: What to do and what to avoid

Extension cord safety: What to do and what to avoid

An extension cord is handy to have in the home or office, but without caution it can become a fire hazard. Here are tips for using an extension cord safely.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Scott Brase

State Farm® Insurance AgentSimple Insights®

Extension cord safety: What to do and what to avoid

Extension cord safety: What to do and what to avoid

An extension cord is handy to have in the home or office, but without caution it can become a fire hazard. Here are tips for using an extension cord safely.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.